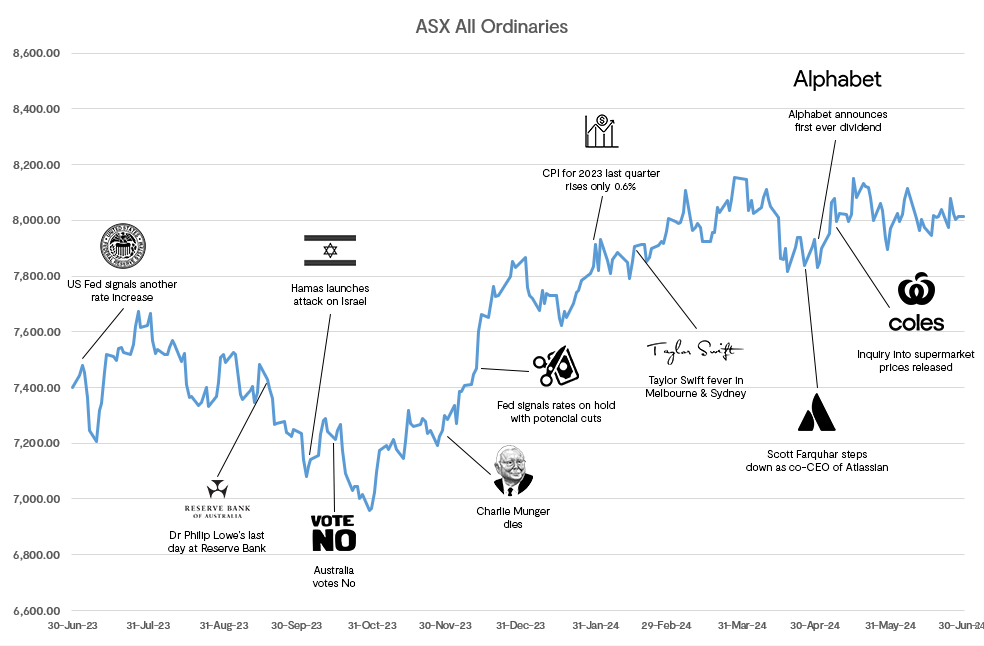

The Australian stock market experienced a positive year from 1 July 2023 to 30 June 2024, marked by ongoing macro-economic themes and notable trends. This period saw a blend of economic resilience and market volatility, influenced by both domestic factors and global conditions. The invasion of Israel by Hamas launched a fresh round of conflict-induced uncertainty in the world alongside a humanitarian disaster. However, the actual impact on equity performance was negligible even while cease-fire proposals have been unsuccessful.

Market Performance

The Australian stock market exhibited a mixed performance over the year. The ASX All Ordinaries Index as a proxy for the market dropped to a low point at the end of October 2023, a decrease 5.96% from 30 June 2023. It quickly recovered for the December reporting period and has ended the year increasing by 8.27% from 30 June 2023. The result this year runs above the ASX All Ordinaries Index long term average of 6.71% indicating that overall market conditions have been favourable for the average investor. Different sectors of the Australian stock market exhibited varied performances. In the sectors where GFL has greater exposure:- Financials: The financial sector showed strong growth, supported by a stable banking environment and increased lending activity. Major banks, including Commonwealth Bank and Westpac, posted reasonable earnings, although rising interest rates pose challenges for borrowers.

- Consumer Discretionary: Despite high interest rates and sustained inflation consumer discretionary showed strong performance during the year. Interestingly, in contrast to the performance of discretionary spend businesses, consumer staples decreased through the period with Coles and Woolworths both down over the last twelve months.

- Technology: A sentiment rotation back to tech stocks is correlated to the emphasis on AI technology and the deployment of new tools in various industries. The big tech companies in the US led this trend generating a disproportionate impact on US index investors.

Australian Economic Indicators

Australia’s Gross Domestic Product (GDP) growth for the year has slowed, reflecting the impact of higher interest rates. At the March 2024 reading, GDP annual growth was 1.1%, driven by continuing domestic consumption and government spending. Housing purchases remain strong while construction of new homes remains weak given multiple pressures in the building industry.

In Australia inflation remained a key measure throughout the year, with the Consumer Price Index (CPI) rising by 2.8% from June 2023 to March 2024 and rising by 3.6% YoY. At the end of 2023 many economists had forecast for interest rates to come down before the end of 2024 with multiple rate cuts expected. However, as it stands this is unlikely to happen due to sustained demand and a relatively resilient labour market preventing the Reserve Bank of Australia (RBA) from easing monetary policy.

Outlook

As we head into the 2024-2025 financial year, the Australian economy and stock market face a mix of opportunities and challenges. Inflationary pressures may persist, prompting a prolonged high interest rate environment. This stance from the RBA will impact sectors of the economy very differently, where businesses (and households) who rely on debt may struggle with sustained cashflow pressure. However, Australia’s robust domestic demand, coupled with its position as a major exporter of commodities, provides grounds for cautious optimism.

Companies that are well run, fiscally sensible, embrace innovation and leverage emerging technologies like AI may be well-positioned to capitalize on growth opportunities and deliver strong returns to investors. In this dynamic environment, disciplined investment processes and a focus on high-quality business franchises with predictable, above-average economic returns will be crucial for achieving superior long-term investment performance.